Will Food Stamps Know If I Get Married Reddit

Will Food Stamps Know If I Get Married?

Marriage is a significant life event, and it’s natural to wonder how it might impact your benefits, including food stamps. In this blog post, we will explore the relationship between marriage and food stamp eligibility, answering the question, “Will food stamps know if I get married?” We’ll provide insights into the reporting requirements, potential impacts on benefits, and strategies to navigate this transition smoothly.

Understanding Food Stamp Eligibility

Food stamps, officially known as the Supplemental Nutrition Assistance Program (SNAP), are designed to assist low-income individuals and families in purchasing nutritious food. Eligibility for SNAP benefits is determined by various factors, including household income, assets, and household size. When you apply for SNAP benefits, you are required to provide accurate information about your household composition, income, and any changes that may affect your eligibility.

Reporting Marriage to Food Stamps

Yes, it is important to report any changes in your marital status to the food stamp program. Marriage is considered a “household change,” and it can have an impact on your benefits. Here’s what you need to know:

- Reporting Requirements: When you get married, you are typically required to report the change to your local SNAP office within a certain timeframe. The specific reporting period may vary depending on your state’s regulations, but it is usually within 10 to 30 days of the marriage.

- Impact on Benefits: The effect of marriage on your food stamp benefits depends on several factors:

- Income and Asset Limits: Marriage may combine your income and assets with your spouse’s, which could potentially affect your eligibility. If your combined income exceeds the SNAP income limits, you may no longer qualify for benefits.

- Household Size: On the other hand, marriage can also increase your household size, which may result in a higher benefit amount. SNAP benefits are calculated based on household size and income, so a larger household could mean a higher monthly allocation.

- Documentation: When reporting your marriage, you will need to provide appropriate documentation, such as a marriage certificate or a change of name certificate (if applicable). Ensure that you have these documents ready when contacting the SNAP office.

Navigating the Transition

If you are planning to get married or have recently tied the knot, here are some steps to help you navigate the transition smoothly:

- Check Eligibility: Before reporting your marriage, it’s a good idea to assess your new household’s eligibility for SNAP benefits. Calculate your combined income and assets and compare them to the SNAP income and asset limits for your state. This will give you an idea of whether your benefits may be affected.

- Contact SNAP Office: Reach out to your local SNAP office to inform them of your marriage. They will guide you through the process of updating your information and may request additional documentation. Be prepared to provide accurate and up-to-date details about your household.

- Understand Potential Changes: The SNAP office will assess your new household’s eligibility based on your combined income and assets. They will determine if your benefits need to be adjusted or if you remain eligible at the same level. It’s essential to understand these changes and how they may impact your budget.

- Explore Alternatives: If your marriage results in a loss of SNAP benefits, explore alternative options to ensure you still have access to nutritious food. Look into other government assistance programs, community food banks, or local initiatives that can provide support.

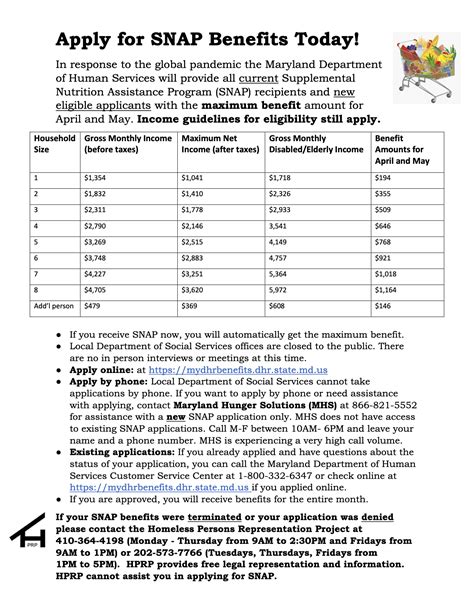

Table: SNAP Income and Asset Limits (Example)

| Household Size | Gross Monthly Income Limit | Net Monthly Income Limit | Asset Limit |

|---|---|---|---|

| 1 | $1,384 | $1,040 | $2,250 |

| 2 | $1,868 | $1,408 | $3,500 |

| 3 | $2,352 | $1,768 | $4,750 |

| 4 | $2,836 | $2,128 | $6,000 |

| Each Additional Member | $484 | $360 | +$1,250 |

Please note that the above table is an example and may not reflect the exact limits in your state. It’s important to check the specific income and asset limits for your area.

Notes:

🛈 Note: Always consult your local SNAP office for accurate and up-to-date information regarding reporting requirements and eligibility. The information provided here is general guidance, and regulations may vary by state.

Final Thoughts

Marriage is a significant life change, and it’s essential to understand how it may impact your food stamp benefits. By reporting your marriage and staying informed about eligibility requirements, you can ensure a smooth transition and continue to access the support you need. Remember to assess your new household’s eligibility, contact the SNAP office promptly, and explore alternative resources if necessary. With proper planning and knowledge, you can navigate this transition with confidence.

FAQ

How long do I have to report my marriage to the SNAP office?

+

The reporting period for marriage typically ranges from 10 to 30 days. It’s important to check your state’s specific regulations to ensure timely reporting.

What happens if I don’t report my marriage to SNAP?

+

Failing to report a change in marital status can result in overpayment of benefits, which may lead to penalties or repayment requirements. It’s crucial to be honest and transparent with the SNAP office.

Can I still receive food stamps if my spouse has a higher income?

+

The impact of your spouse’s income on your SNAP eligibility depends on your state’s rules. Some states consider the combined income of married couples, while others have separate eligibility criteria for married couples.

Are there any exceptions for reporting marriage to SNAP?

+

In certain situations, such as domestic violence or safety concerns, you may be able to request a waiver or special consideration when reporting your marriage. Contact your local SNAP office for guidance in such cases.

How can I find the income and asset limits for my state’s SNAP program?

+

You can visit your state’s official SNAP website or contact your local SNAP office to obtain the specific income and asset limits for your area. These limits may vary, so it’s important to check the accurate information for your state.