Ultimate Guide To Affordable Uc Davis Tuition Now

Introduction: Navigating the Cost of Education at UC Davis

Pursuing higher education at the University of California, Davis (UC Davis) can be an exciting and life-changing experience, but the financial aspect of it can be daunting. Tuition fees are a significant concern for many students and their families, especially when it comes to prestigious universities like UC Davis. However, there are ways to make the dream of attending this esteemed institution more affordable. In this comprehensive guide, we will explore various strategies and insights to help you navigate the costs and make the most of your educational journey at UC Davis without breaking the bank.

Understanding UC Davis Tuition and Fees

Before delving into the strategies for affording UC Davis tuition, it’s essential to have a clear understanding of the costs involved. UC Davis, like many universities, offers a range of programs and degrees, and the tuition fees can vary depending on various factors. Let’s break down the key components:

Tuition and Fees Structure:

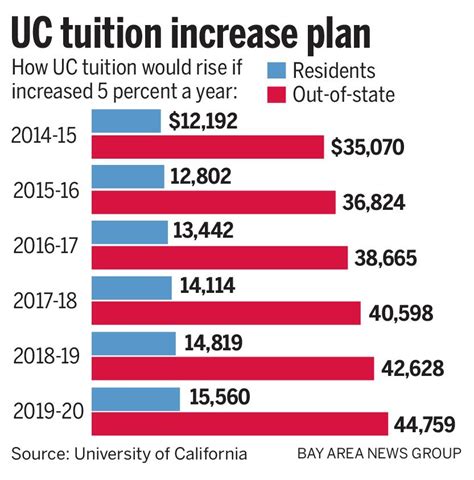

- Resident vs. Non-Resident Tuition: UC Davis offers a differential tuition rate for residents and non-residents of California. Residents typically pay lower tuition fees, making it more affordable for in-state students.

- Undergraduate Tuition: The tuition for undergraduate programs can vary based on the college and major. On average, residents pay around $14,000 per year, while non-residents may incur higher costs.

- Graduate Tuition: Graduate programs often have different tuition structures. For example, the UC Davis Graduate School of Management has a specific tuition rate.

- Additional Fees: Apart from tuition, there are mandatory fees such as the Student Services Fee, Health Services Fee, and various campus-specific fees. These fees cover services and facilities provided by the university.

Cost of Living:

- Housing and Accommodation: Living expenses play a significant role in the overall cost of attending UC Davis. On-campus housing options range from residence halls to apartments, with varying rates. Off-campus housing can be more affordable but requires additional considerations.

- Meal Plans and Groceries: UC Davis offers meal plans for students living on campus, and there are also dining options available on and off campus. Budgeting for food expenses is crucial.

- Transportation: The cost of transportation can vary depending on your preferred mode of travel. Many students opt for biking or using public transportation, which can be cost-effective.

Financial Aid and Scholarships:

UC Davis is committed to providing financial support to its students. Here’s an overview of the financial aid opportunities: - Financial Aid Packages: Students can receive a combination of grants, scholarships, work-study, and loans to cover their educational expenses. The university aims to meet the demonstrated financial need of admitted students. - UC Davis Grants and Scholarships: UC Davis offers various institutional scholarships, such as the Regents and Chancellor’s Scholarships, which provide substantial financial assistance. These scholarships are highly competitive and based on academic merit. - External Scholarships: Students can explore external scholarship opportunities from private organizations, foundations, and community groups. These scholarships can significantly reduce the financial burden.

Strategies for Affording UC Davis Tuition

Now that we have a grasp of the financial landscape, let’s explore some effective strategies to make UC Davis tuition more affordable:

1. Apply for Financial Aid Early

- Complete the FAFSA: The Free Application for Federal Student Aid (FAFSA) is a crucial step in accessing financial aid. Submit your FAFSA as soon as possible after October 1st to maximize your chances of receiving aid.

- Understand Eligibility: Research the financial aid eligibility criteria for UC Davis. Factors such as income, assets, and family size play a role in determining your financial need.

- Gather Required Documents: Prepare all the necessary documents, including tax returns, bank statements, and other financial records, to streamline the application process.

2. Explore UC Davis Scholarships and Grants

- Regents and Chancellor’s Scholarships: These prestigious scholarships provide significant financial support. Apply early and demonstrate your academic excellence and leadership potential.

- Departmental Scholarships: Many departments and colleges at UC Davis offer scholarships specifically for their students. Research the scholarships available in your chosen field of study.

- External Scholarships: In addition to UC Davis scholarships, explore external scholarship opportunities. Websites like Fastweb and Scholarships.com can help you find scholarships based on your interests and qualifications.

3. Consider Work-Study Programs

- Federal Work-Study: UC Davis participates in the Federal Work-Study program, which provides part-time employment opportunities for students with financial need. These jobs can help cover your educational expenses.

- On-Campus Jobs: Even if you are not eligible for work-study, there are plenty of on-campus job opportunities available. Working as a teaching or research assistant, in the library, or in various administrative roles can provide valuable experience and a source of income.

4. Manage Your Budget Wisely

- Create a Budget: Develop a realistic budget that includes tuition, fees, housing, meals, transportation, and other living expenses. Track your spending to ensure you stay within your means.

- Explore Cost-Saving Options: Look for affordable housing options, such as shared apartments or residence halls with meal plans. Cook your meals instead of eating out frequently to save money.

- Utilize Campus Resources: Take advantage of the free or discounted services and facilities offered by UC Davis. This includes libraries, computer labs, recreational centers, and career development resources.

5. Explore Loan Options

- Federal Student Loans: Consider federal student loans, which often have lower interest rates and more flexible repayment options. The Direct Loan Program and the Perkins Loan Program are popular choices.

- Private Student Loans: If federal loans do not cover your entire financial need, private student loans can be an option. However, be cautious and compare interest rates and terms before borrowing.

- Repayment Plans: Understand the repayment options available for your loans. Some loans offer income-driven repayment plans, which can make monthly payments more manageable.

6. Attend UC Davis Part-Time

- Part-Time Enrollment: If full-time attendance is not feasible due to financial constraints, consider enrolling part-time. This can help spread out the cost of tuition and allow you to work while studying.

- Tuition Waivers: In some cases, UC Davis offers tuition waivers for specific programs or circumstances. Research these opportunities and see if you are eligible.

7. Seek External Support

- Family Contributions: Discuss the financial aspect of attending UC Davis with your family. Many families contribute to their children’s education, and open communication can lead to a collaborative solution.

- Community Organizations: Explore local community organizations, churches, or cultural centers that may offer scholarships or financial support to students.

- Crowdfunding: Consider crowdfunding platforms to raise funds for your education. Many students have successfully used platforms like GoFundMe to receive support from their communities.

Tips for Success at UC Davis

In addition to managing the financial aspects, here are some tips to make the most of your time at UC Davis:

- Attend Orientation: UC Davis offers comprehensive orientation programs to help new students adjust to campus life. Attend these sessions to learn about campus resources, academic requirements, and social opportunities.

- Connect with Academic Advisors: Your academic advisor can provide valuable guidance on course selection, degree requirements, and career paths. Regularly meet with them to stay on track and make informed decisions.

- Join Clubs and Organizations: UC Davis has a vibrant campus life with numerous clubs and organizations. Getting involved can enhance your college experience, build connections, and provide leadership opportunities.

- Utilize Library Resources: The UC Davis Libraries offer extensive resources, including books, journals, and online databases. Make use of these resources for research and academic support.

- Take Advantage of Career Services: The UC Davis Career Center provides valuable resources for career exploration, resume building, and interview preparation. Start early to maximize your career prospects.

Conclusion: Making Your UC Davis Journey Affordable

Attending UC Davis is an investment in your future, and with careful planning and the right strategies, it can be an affordable and rewarding experience. By understanding the tuition structure, exploring financial aid options, and managing your budget wisely, you can make your dream of attending this prestigious university a reality. Remember, financial aid and scholarships are competitive, so start your research early and take advantage of all the resources available to you. With determination and a well-thought-out plan, you can navigate the costs and make the most of your educational journey at UC Davis.

FAQ

What is the average cost of tuition at UC Davis for in-state students?

+The average tuition for in-state students at UC Davis is approximately $14,000 per year. However, it’s important to note that this amount can vary depending on the program and college.

Are there any scholarships specifically for international students at UC Davis?

+Yes, UC Davis offers a limited number of scholarships for international students. These scholarships are highly competitive and based on academic merit. International students are encouraged to explore external scholarship opportunities as well.

Can I work part-time while attending UC Davis to cover my expenses?

+Absolutely! UC Davis offers a range of on-campus job opportunities through the Federal Work-Study program and other part-time positions. Working part-time can help cover your expenses and provide valuable work experience.

Are there any tuition waivers available at UC Davis?

+Yes, UC Davis offers tuition waivers for specific programs and circumstances. These waivers can be based on financial need, academic achievement, or other factors. It’s important to research and inquire about these opportunities.

How can I stay updated on financial aid and scholarship deadlines at UC Davis?

+The best way to stay informed is to regularly check the UC Davis Financial Aid and Scholarship website. They provide updates on deadlines, application requirements, and important announcements. Additionally, subscribe to their email newsletters for timely information.