Ny Ebt Application

The Ny Ebt Application is a revolutionary tool designed to streamline and simplify the process of Electronic Billing and Tax collection for businesses in New York. With its user-friendly interface and advanced features, this application has become an essential companion for businesses operating within the state, ensuring compliance and efficient management of financial obligations.

Understanding the Ny Ebt Application

The Ny Ebt Application is a web-based platform developed by the New York State Department of Taxation and Finance. It serves as a centralized hub for businesses to manage their tax obligations, including sales tax, use tax, and various other taxes applicable within the state.

This application offers a range of benefits, making it an indispensable tool for businesses of all sizes. From small startups to large enterprises, the Ny Ebt Application provides a seamless and secure environment for tax management, reducing the burden of manual paperwork and potential errors.

Key Features of the Ny Ebt Application

Simplified Tax Registration

One of the standout features of the application is its streamlined tax registration process. Businesses can easily register for the necessary tax permits and licenses, ensuring they meet all legal requirements before commencing operations.

Efficient Tax Filing

The Ny Ebt Application simplifies the tax filing process, allowing businesses to submit their tax returns electronically. This not only saves time but also reduces the risk of errors associated with manual filing.

Real-time Tax Calculations

With this application, businesses can benefit from real-time tax calculations. It automatically computes the applicable taxes based on the nature of the transaction, ensuring accurate and compliant billing.

Secure Payment Gateway

The application integrates a secure payment gateway, enabling businesses to make tax payments electronically. This feature enhances security and provides a convenient method for tax settlement.

Comprehensive Reporting

Businesses can generate detailed reports on their tax obligations and payments. These reports offer valuable insights into financial performance and can be used for internal analysis or external audits.

How to Access and Use the Ny Ebt Application

Registration Process

To begin using the Ny Ebt Application, businesses must first register on the platform. The registration process involves providing basic business information and selecting the appropriate tax types.

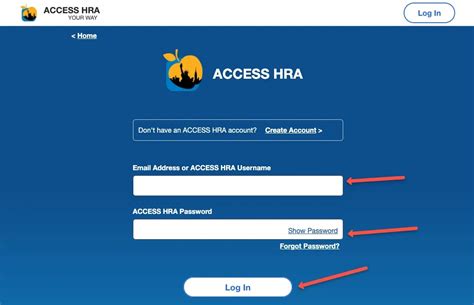

Logging In

Once registered, businesses can log in to the application using their unique credentials. The login page is secure and accessible through the official website of the New York State Department of Taxation and Finance.

Navigating the Dashboard

The application's dashboard is user-friendly and intuitive. It provides a centralized view of all tax-related activities, including pending returns, payment due dates, and tax notifications.

Filing Taxes

Filing taxes through the Ny Ebt Application is straightforward. Businesses can input the necessary details, such as sales figures and tax rates, and the application will automatically calculate the tax liability.

Making Payments

The application offers multiple payment options, including credit card, electronic funds transfer, and check. Businesses can choose the most convenient method and settle their tax obligations securely.

Benefits of Using the Ny Ebt Application

Compliance and Accuracy

By using the Ny Ebt Application, businesses can ensure compliance with New York's tax regulations. The application's automated processes reduce the risk of errors, ensuring accurate tax calculations and filings.

Time and Cost Savings

The application streamlines the tax management process, saving businesses valuable time and resources. The electronic filing and payment options eliminate the need for manual paperwork, reducing administrative costs.

Improved Cash Flow Management

With real-time tax calculations and payment reminders, businesses can better manage their cash flow. The application helps businesses stay on top of their tax obligations, avoiding late payment penalties and interest charges.

Enhanced Data Security

The Ny Ebt Application prioritizes data security, employing advanced encryption technologies to protect sensitive business and financial information. This ensures that businesses can trust the platform with their critical data.

Tips for Effective Utilization

Stay Updated with Tax Regulations

New York's tax regulations are subject to change. It is essential for businesses to stay informed about any updates or amendments to ensure compliance. The Ny Ebt Application provides regular notifications and alerts regarding tax-related changes.

Utilize Reporting Features

The comprehensive reporting features of the application can be leveraged for strategic decision-making. Businesses can analyze their tax performance, identify areas for improvement, and make informed financial choices.

Seek Professional Guidance

For complex tax matters or specific queries, businesses can seek guidance from tax professionals or consultants. They can provide expert advice and ensure optimal utilization of the Ny Ebt Application.

Support and Resources

The New York State Department of Taxation and Finance offers extensive support and resources for businesses using the Ny Ebt Application. These include user guides, FAQs, and a dedicated help desk for assistance with any technical or operational issues.

Conclusion

The Ny Ebt Application is a powerful tool that empowers businesses in New York to manage their tax obligations efficiently and effectively. With its user-friendly interface, advanced features, and secure environment, it has become an integral part of modern tax management practices. By leveraging this application, businesses can focus on their core operations while ensuring compliance and financial stability.

What are the system requirements for the Ny Ebt Application?

+The Ny Ebt Application is a web-based platform and can be accessed through any modern web browser. It is compatible with various operating systems, including Windows, macOS, and Linux. A stable internet connection is required for optimal performance.

How secure is the Ny Ebt Application?

+The application employs advanced security measures, including encryption and secure socket layer (SSL) technology, to protect user data. It complies with industry standards and regulations to ensure the confidentiality and integrity of sensitive information.

Can businesses register for multiple tax types through the Ny Ebt Application?

+Yes, the application allows businesses to register for multiple tax types, such as sales tax, use tax, and more. This simplifies the registration process and provides a centralized platform for managing all tax obligations.

Are there any fees associated with using the Ny Ebt Application?

+The Ny Ebt Application is provided free of charge by the New York State Department of Taxation and Finance. However, there may be nominal fees associated with certain payment methods, such as credit card transactions.

Can businesses access their tax records and returns through the Ny Ebt Application?

+Absolutely! The application provides a secure archive of all tax-related documents, including returns, payments, and correspondence. Businesses can easily access and download these records for future reference or audit purposes.