Georgia Tobacco Tax Excel Sheet

Georgia Tobacco Tax Excel Sheet: A Comprehensive Guide

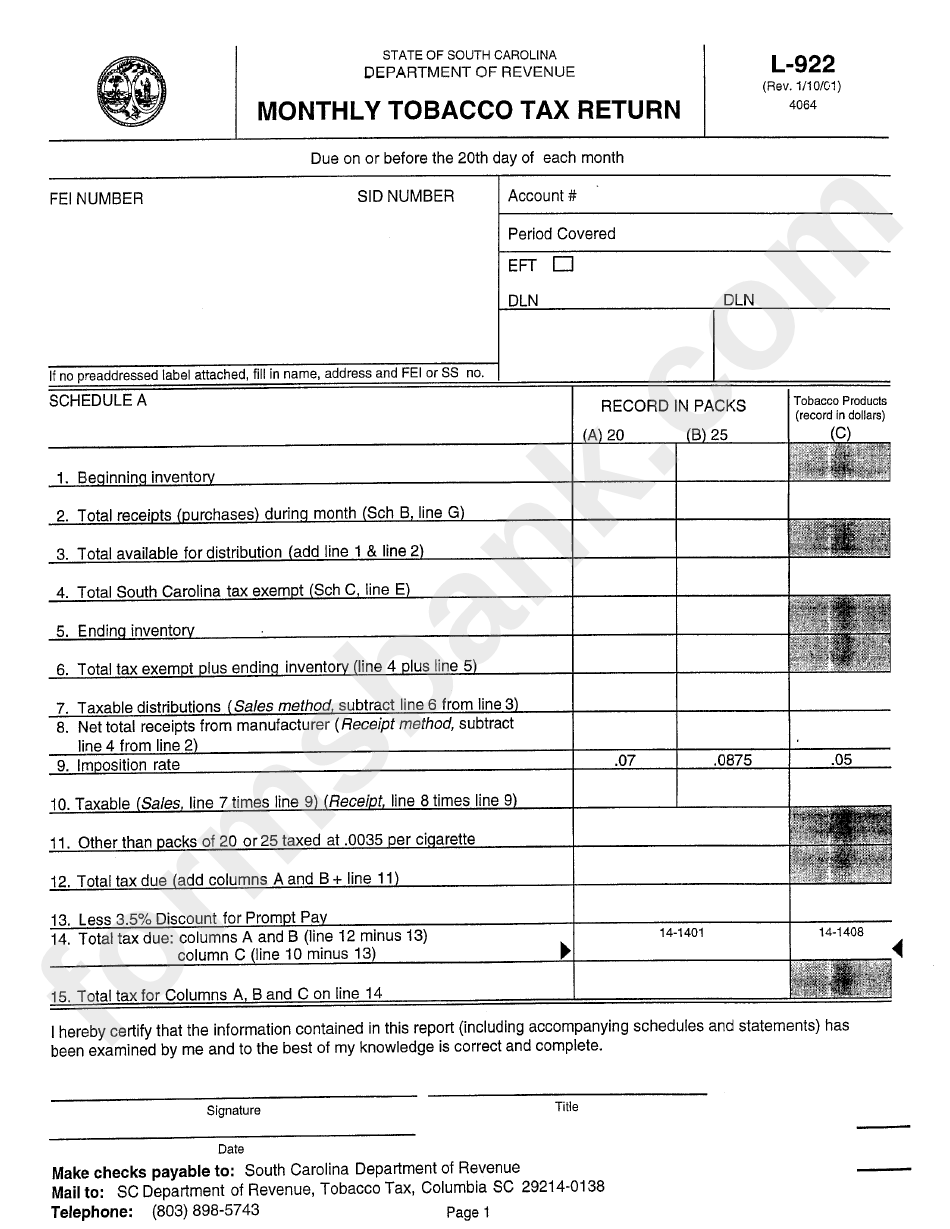

In the state of Georgia, tobacco products are subject to various taxes and regulations. To help businesses and individuals navigate the complex world of tobacco taxation, the Georgia Department of Revenue has provided an Excel sheet that calculates and manages tobacco tax liabilities. This guide will walk you through the process of using the Georgia Tobacco Tax Excel Sheet, offering a step-by-step explanation and valuable insights.

Understanding the Purpose of the Excel Sheet

The Georgia Tobacco Tax Excel Sheet is a powerful tool designed to assist taxpayers in accurately calculating and reporting their tobacco tax obligations. It is an official resource provided by the state to ensure compliance with tax laws and regulations. By utilizing this sheet, taxpayers can streamline their tax management process and avoid potential penalties for non-compliance.

Downloading and Opening the Excel Sheet

To access the Georgia Tobacco Tax Excel Sheet, you can visit the official website of the Georgia Department of Revenue. Here’s a step-by-step guide:

- Go to the Georgia Department of Revenue website.

- Navigate to the "Tax Forms and Publications" section.

- Search for "Tobacco Tax Excel Sheet" or look for a similar name.

- Once you find the Excel sheet, download it to your device.

- Open the downloaded file using Microsoft Excel or a compatible spreadsheet software.

Exploring the Excel Sheet

Upon opening the Excel sheet, you’ll notice a user-friendly interface with various tabs and sections. Each tab serves a specific purpose, allowing you to input data, calculate taxes, and generate reports. Let’s explore the key components:

Input Tab

The Input tab is where you enter all the necessary information related to your tobacco sales or purchases. Here's a breakdown of the fields you'll find:

- Date: Input the date of the transaction.

- Type of Tobacco: Select the type of tobacco product from a dropdown list (e.g., cigarettes, cigars, chewing tobacco).

- Quantity: Enter the quantity of tobacco products sold or purchased.

- Unit Price: Specify the price per unit of the tobacco product.

- Tax Rate: The tax rate will be automatically populated based on the selected tobacco type.

- Tax Amount: This field will calculate the tax amount based on the quantity and tax rate.

Calculation Tab

The Calculation tab is where the magic happens! It performs the necessary calculations to determine your total tobacco tax liability. Here's a glimpse of what you'll find:

- Subtotal: The subtotal of all tax amounts calculated in the Input tab.

- Discounts: If applicable, you can input any discounts or exemptions here.

- Total Tax Due: This field will display the final tax amount you owe, taking into account any discounts.

Report Tab

The Report tab generates a comprehensive report of your tobacco tax transactions. It provides a summary of all the data entered in the Input tab, along with the calculated tax amounts and totals. This report can be extremely useful for record-keeping and auditing purposes.

Step-by-Step Guide to Using the Excel Sheet

Now that we’ve explored the structure of the Excel sheet, let’s dive into a detailed step-by-step guide on how to utilize it effectively:

-

Open the Excel Sheet

Launch Microsoft Excel and open the downloaded Georgia Tobacco Tax Excel Sheet.

-

Familiarize Yourself with the Tabs

Take a moment to navigate through the different tabs: Input, Calculation, and Report. Understand the purpose of each tab and the information it contains.

-

Enter Transaction Details

Go to the Input tab and start entering your tobacco sales or purchases. Fill in the Date, Type of Tobacco, Quantity, Unit Price, and let the sheet calculate the Tax Amount.

-

Review and Edit as Needed

After inputting your transactions, review the data to ensure accuracy. You can make edits or additions as required.

-

Calculate Tax Liability

Once you're satisfied with the input data, navigate to the Calculation tab. Here, the Excel sheet will automatically calculate your total tax liability based on the entered transactions.

-

Generate a Report

To create a comprehensive report, switch to the Report tab. This tab provides a summary of your transactions, including the tax amounts and totals. You can use this report for your records or for submitting tax returns.

-

Save and Update Regularly

It's crucial to save your Excel sheet regularly to avoid losing any data. Additionally, remember to update the sheet whenever you have new tobacco transactions to ensure accurate tax calculations.

Important Notes and Tips

Note: Always double-check the accuracy of the data entered into the Excel sheet. Incorrect information can lead to miscalculations and potential tax issues.

Note: Keep in mind that the Georgia Tobacco Tax Excel Sheet is a tool to assist you in calculating taxes. It is important to refer to the official tax regulations and guidelines provided by the Georgia Department of Revenue for the most up-to-date and accurate information.

Note: If you encounter any issues or have questions while using the Excel sheet, you can reach out to the Georgia Department of Revenue for assistance. Their support team can provide guidance and clarify any doubts you may have.

Conclusion

The Georgia Tobacco Tax Excel Sheet is a valuable resource for businesses and individuals operating in the tobacco industry in Georgia. By following this comprehensive guide, you can efficiently utilize the Excel sheet to calculate and manage your tobacco tax liabilities. Remember to stay updated with the latest tax regulations and seek professional advice if needed. With accurate tax calculations and timely submissions, you can ensure compliance and avoid any potential penalties.

FAQ

Can I use the Excel sheet for multiple tax periods?

+Yes, the Excel sheet is designed to accommodate multiple tax periods. You can input transactions for different periods and generate separate reports for each.

What if I need to make changes to previously entered data?

+You can easily edit or delete transactions in the Input tab. Simply navigate to the relevant row and make the necessary changes. The Calculation and Report tabs will automatically update based on your modifications.

How often should I update the Excel sheet with new transactions?

+It is recommended to update the Excel sheet regularly, preferably after each transaction or at least once a month. This ensures that your tax calculations are up-to-date and accurate.

Can I customize the Excel sheet to include additional fields or calculations?

+While the Excel sheet is pre-formatted, you can customize it to some extent. You can add additional columns or rows to accommodate specific needs. However, be cautious when making modifications to ensure the integrity of the calculations.

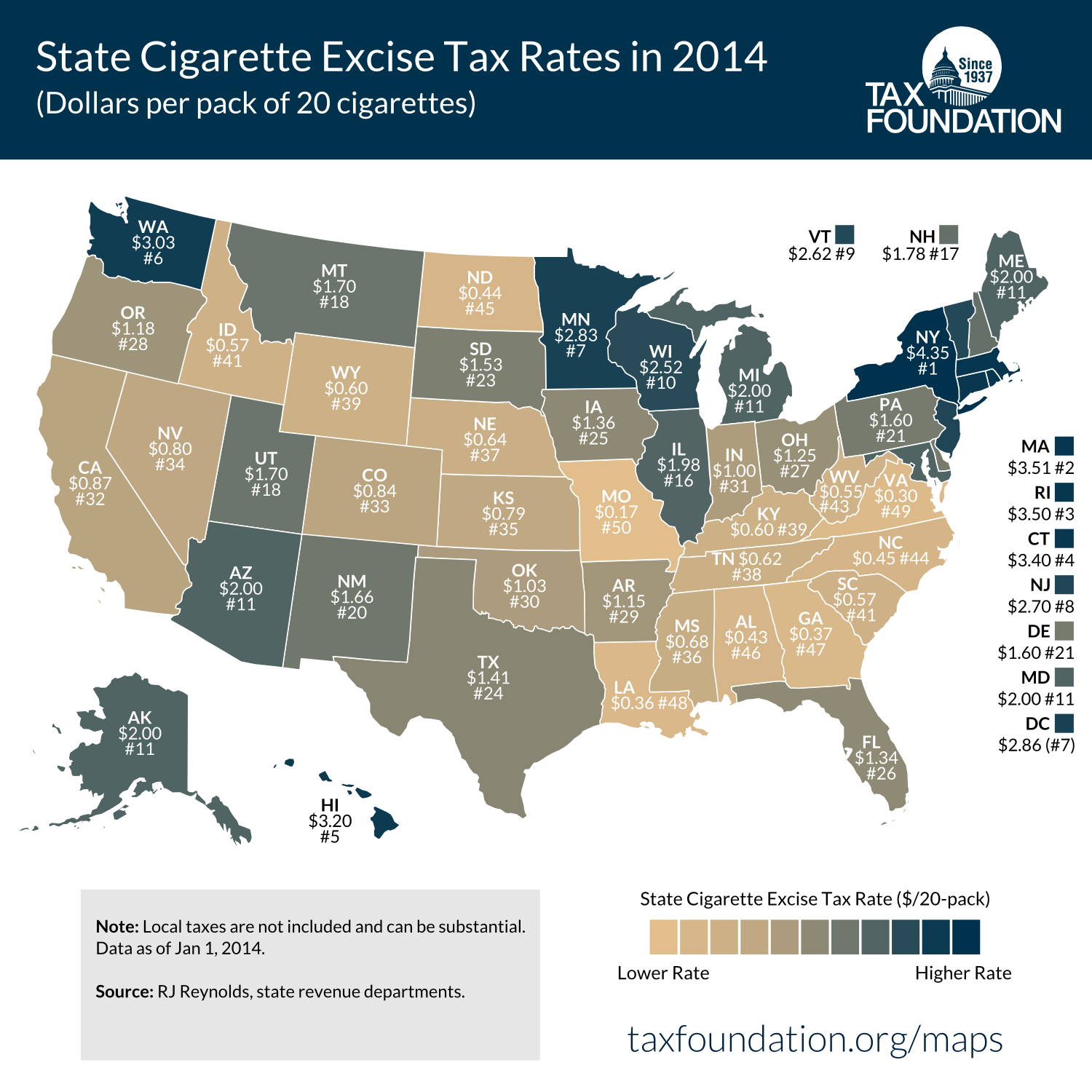

Where can I find the latest tax rates and regulations for Georgia tobacco taxes?

+The Georgia Department of Revenue website is the official source for the latest tax rates and regulations. Visit their website regularly to stay updated with any changes or updates.