Dividend Valuation Model Excel Download Free

Understanding the value of a stock and its potential returns is crucial for any investor. One popular method to assess the worth of a company's stock is through the Dividend Valuation Model. This model provides a comprehensive framework to evaluate a company's intrinsic value based on its dividend payments. In this blog post, we will delve into the Dividend Valuation Model, its components, and how you can use it to make informed investment decisions. Additionally, we will provide a free Excel template for you to download and start analyzing stocks right away.

What is the Dividend Valuation Model?

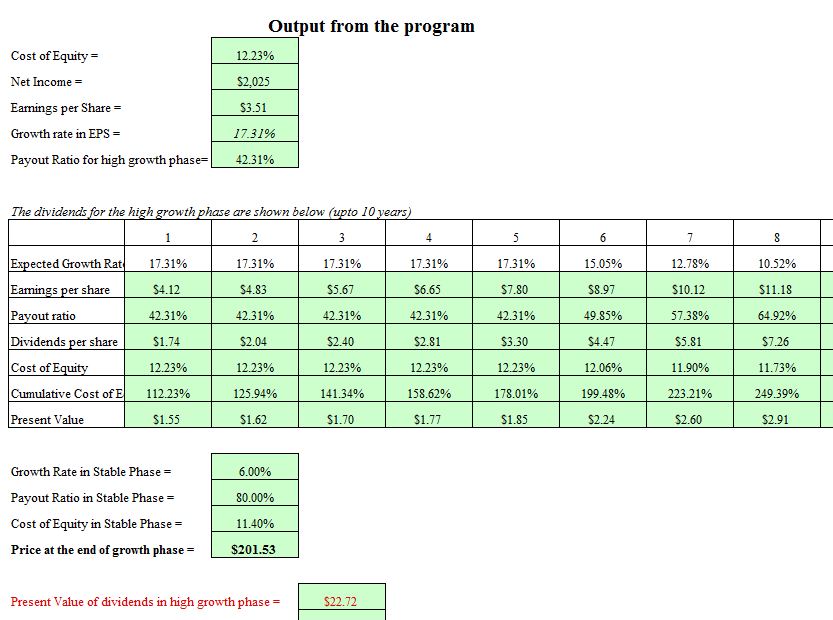

The Dividend Valuation Model, also known as the Gordon Growth Model, is a financial tool used to estimate the intrinsic value of a stock. It is primarily based on the dividends a company pays to its shareholders. This model assumes that the value of a stock is determined by the present value of its future dividend payments. By discounting these future dividends back to their present value, investors can assess whether a stock is overvalued or undervalued.

The key assumption of the Dividend Valuation Model is that a company's dividend payments will grow at a constant rate indefinitely. This growth rate is a crucial factor in determining the stock's intrinsic value. The model also considers the required rate of return that investors expect from their investments.

Components of the Dividend Valuation Model

The Dividend Valuation Model consists of several key components that work together to calculate the intrinsic value of a stock. These components are:

- Dividend per Share (D0): This is the current dividend paid by the company per share of stock. It is the starting point for the valuation process.

- Constant Growth Rate (g): The expected growth rate of the company's dividend payments. This rate should be sustainable and represent the long-term growth prospects of the company.

- Required Rate of Return (r): Also known as the discount rate, this represents the minimum rate of return that investors demand for their investment. It takes into account the risk associated with the investment.

By plugging these values into the Dividend Valuation Model formula, we can calculate the intrinsic value of the stock.

The Dividend Valuation Model Formula

The formula for the Dividend Valuation Model is as follows:

Intrinsic Value = D0 / (r - g)

Where:

- Intrinsic Value: The estimated value of the stock based on its dividend payments.

- D0: Current dividend per share.

- r: Required rate of return.

- g: Constant growth rate of dividends.

This formula helps investors determine whether the current market price of a stock is aligned with its intrinsic value. If the calculated intrinsic value is higher than the market price, it indicates that the stock may be undervalued and could be a good investment opportunity.

Advantages of the Dividend Valuation Model

The Dividend Valuation Model offers several advantages for investors:

- Simplicity: It is a straightforward and easy-to-understand model, making it accessible to both novice and experienced investors.

- Focus on Dividends: By considering dividend payments, the model provides insights into a company's ability to generate consistent cash flows and reward its shareholders.

- Intrinsic Value Estimation: The model helps investors assess whether a stock is fairly valued, overvalued, or undervalued, aiding in making informed investment decisions.

Limitations and Considerations

While the Dividend Valuation Model is a valuable tool, it does have certain limitations:

- Constant Growth Assumption: The model assumes a constant growth rate for dividend payments, which may not always hold true in reality. Companies may experience fluctuations in their growth rates.

- Dividend-Paying Companies: This model is most applicable to companies that pay dividends regularly. It may not be suitable for companies that do not distribute dividends or have inconsistent dividend policies.

- Sensitivity to Input Values: The accuracy of the model depends on the correctness of the input values, especially the growth rate and required rate of return. Small changes in these values can significantly impact the calculated intrinsic value.

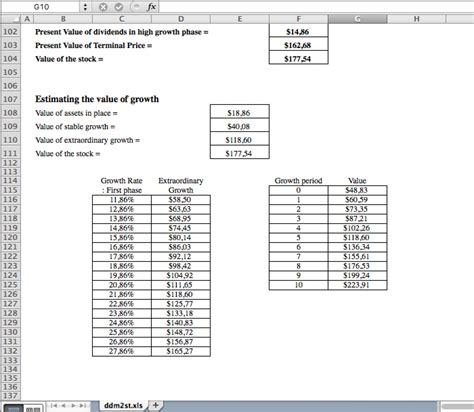

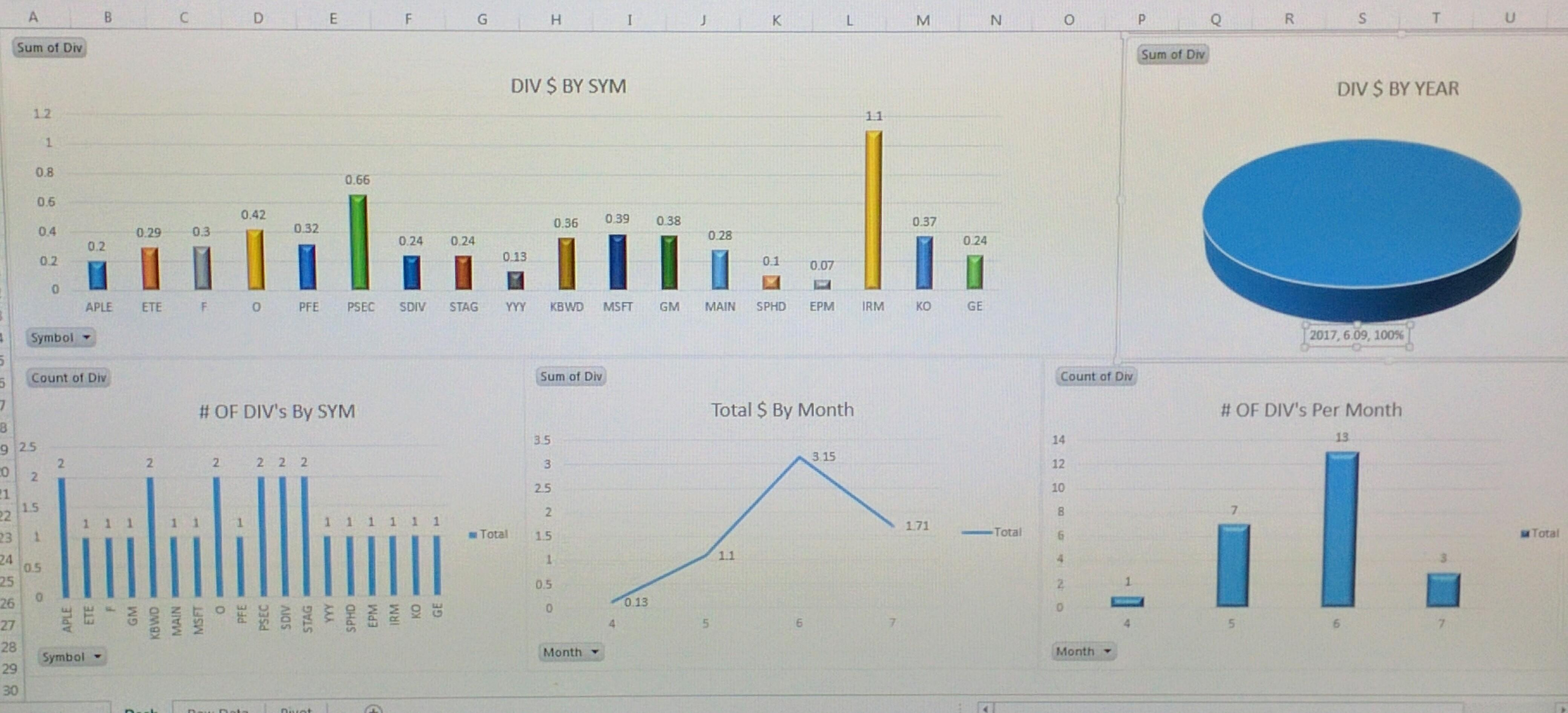

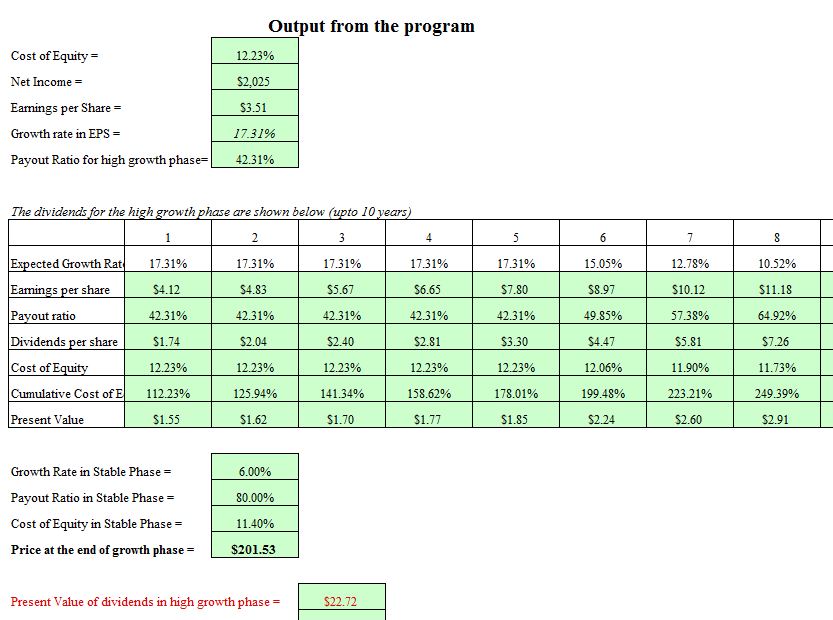

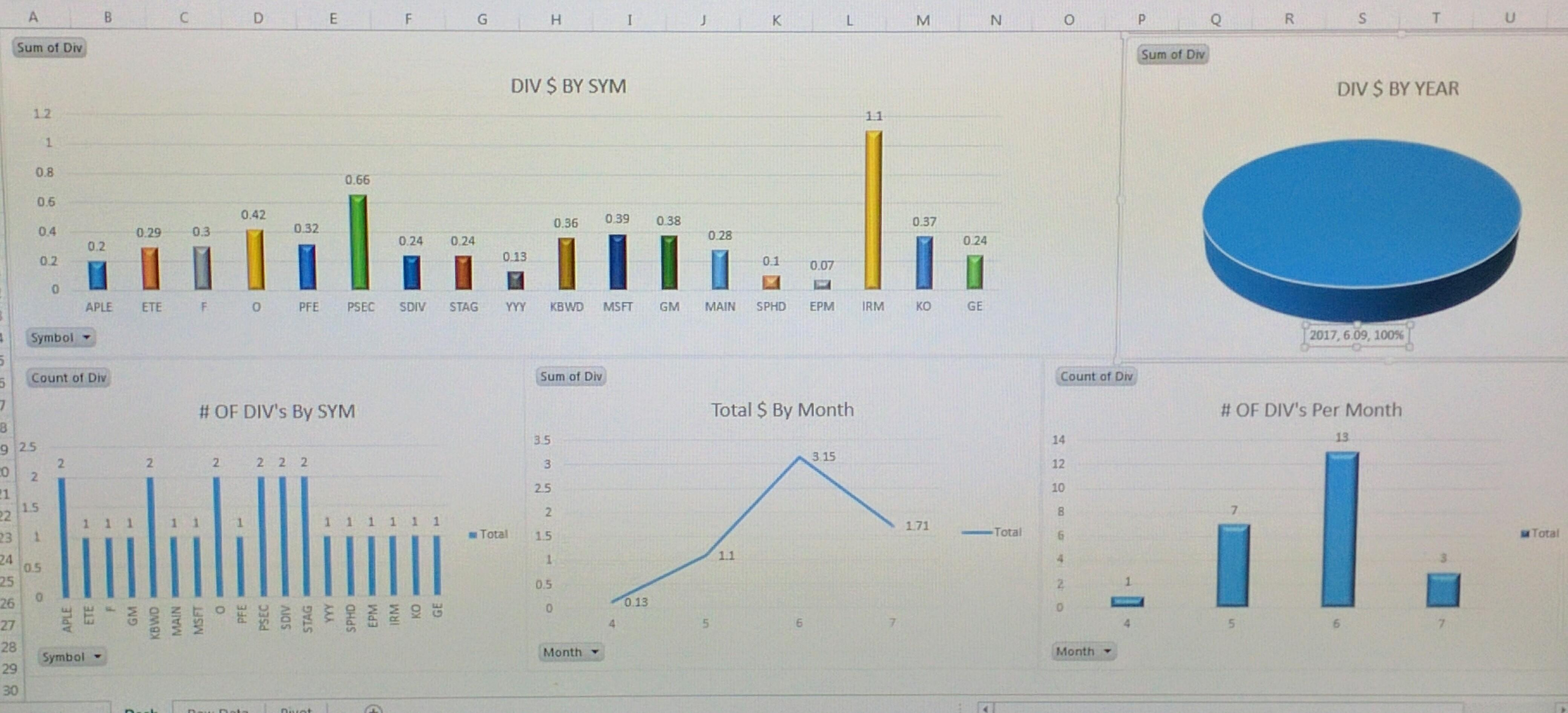

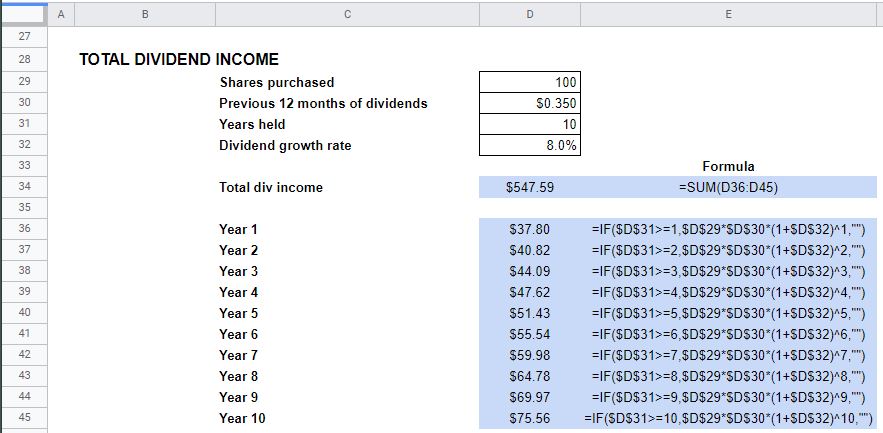

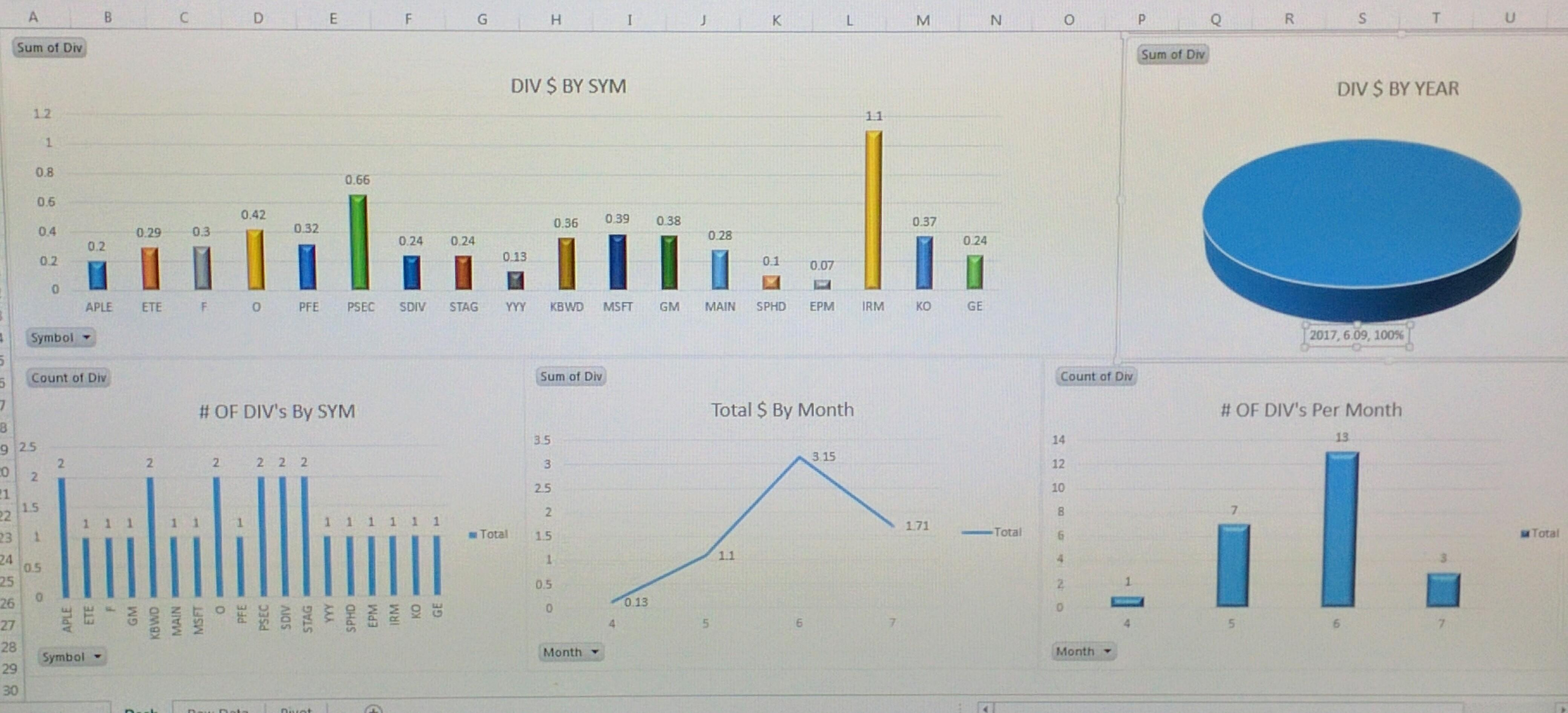

How to Use the Dividend Valuation Model Excel Template

To make it easier for you to apply the Dividend Valuation Model, we have created a free Excel template that you can download and use. This template will guide you through the valuation process step by step.

Step 1: Download the Template

Click the link below to download the Dividend Valuation Model Excel template:

Download Dividend Valuation Model Excel Template

Step 2: Input Your Data

Once you have downloaded the template, open it in Excel. You will see a user-friendly interface with clearly labeled input fields.

- Enter the Current Dividend per Share (D0) in the designated cell.

- Input the Constant Growth Rate (g) that you believe represents the company's long-term growth prospects.

- Specify the Required Rate of Return (r) based on your risk tolerance and market conditions.

Step 3: Calculate Intrinsic Value

With your input values in place, the Excel template will automatically calculate the intrinsic value of the stock using the Dividend Valuation Model formula. The result will be displayed in the designated cell.

Step 4: Compare and Analyze

Compare the calculated intrinsic value with the current market price of the stock. If the intrinsic value is higher, it suggests that the stock may be undervalued. Consider further research and analysis before making any investment decisions.

Important Notes

🚨 Note: The Dividend Valuation Model is a valuable tool, but it should be used in conjunction with other valuation methods and fundamental analysis. It is important to consider a company's financial health, industry trends, and other relevant factors before making investment decisions.

📈 Tip: Regularly update your inputs and recalculate the intrinsic value as new information becomes available. This will help you stay informed and make timely investment adjustments.

Conclusion

The Dividend Valuation Model is a powerful tool for investors to assess the intrinsic value of stocks based on their dividend payments. By understanding the components and limitations of this model, investors can make more informed decisions. Our free Excel template simplifies the valuation process, allowing you to quickly estimate intrinsic values and compare them with market prices. Remember to consider other factors and conduct thorough research before making any investments.

Frequently Asked Questions

What is the significance of the constant growth rate in the Dividend Valuation Model?

+

The constant growth rate represents the expected growth of dividend payments over time. It is a crucial factor in determining the intrinsic value of the stock. A higher growth rate indicates stronger dividend growth and, consequently, a higher intrinsic value.

How often should I update the inputs in the Excel template?

+

It is recommended to update the inputs periodically, especially when there are significant changes in the company’s dividend policy, financial performance, or market conditions. Regular updates ensure that your valuation remains relevant and accurate.

Can I use the Dividend Valuation Model for non-dividend-paying companies?

+

The Dividend Valuation Model is most suitable for companies that pay regular dividends. For non-dividend-paying companies, other valuation models, such as the Discounted Cash Flow (DCF) model, may be more appropriate.

What if the calculated intrinsic value is lower than the market price?

+

If the intrinsic value is lower than the market price, it suggests that the stock may be overvalued. In such cases, investors might consider waiting for a more favorable entry point or exploring other investment opportunities.

Are there any alternatives to the Dividend Valuation Model for stock valuation?

+

Yes, there are several alternative valuation models, including the Price-Earnings (P/E) ratio, Price-to-Book (P/B) ratio, and the aforementioned Discounted Cash Flow (DCF) model. Each model has its own strengths and weaknesses, and investors often use a combination of these methods for a comprehensive analysis.