Design Your Ebt Atm Strategy: Ultimate Guide

Designing an effective Electronic Benefits Transfer (EBT) ATM strategy is crucial for ensuring seamless access to funds for recipients of government assistance programs. In this guide, we will explore the key steps and considerations to develop a comprehensive EBT ATM strategy that meets the needs of your target audience.

Understanding EBT and Its Purpose

EBT is an electronic system used by government agencies to distribute benefits, such as food assistance and cash benefits, to eligible individuals and families. The primary goal of EBT is to provide a secure and efficient way to access and utilize these benefits, replacing traditional paper-based systems.

By implementing an EBT ATM strategy, you can offer convenient and accessible cash withdrawal options to beneficiaries, empowering them to manage their finances effectively.

Identifying Target Audience and Their Needs

Before designing your EBT ATM strategy, it is essential to understand the demographics and needs of your target audience. Conduct thorough research to identify the following key factors:

- Geographic distribution of beneficiaries

- Preferred methods of accessing benefits (e.g., ATM, point-of-sale transactions, online)

- Common financial institutions and ATM networks used by beneficiaries

- Any specific requirements or challenges faced by beneficiaries, such as limited access to transportation or technological barriers

Understanding these factors will help you tailor your EBT ATM strategy to meet the unique needs of your target audience.

Selecting the Right ATM Network

Choosing the appropriate ATM network is a critical aspect of your EBT ATM strategy. Consider the following factors when selecting an ATM network partner:

- Network coverage: Ensure that the ATM network has a wide reach, covering the areas where your beneficiaries reside. This will guarantee convenient access to ATMs for cash withdrawals.

- Interoperability: Opt for an ATM network that supports interoperability, allowing beneficiaries to use their EBT cards at various ATMs, regardless of the issuing financial institution.

- Transaction fees: Evaluate the transaction fees charged by different ATM networks. Consider negotiating lower fees or offering fee waivers for EBT transactions to reduce the financial burden on beneficiaries.

- Security and fraud prevention: Select an ATM network with robust security measures to protect beneficiaries' financial information and prevent fraud.

By carefully selecting an ATM network that aligns with your strategy, you can provide a seamless and secure EBT ATM experience for your target audience.

Implementing EBT ATM Features and Functionality

Once you have selected an ATM network, it is essential to implement EBT-specific features and functionality to enhance the user experience. Consider the following aspects:

- Customized EBT screens: Design user-friendly screens on ATMs specifically for EBT transactions. These screens should clearly guide beneficiaries through the withdrawal process, providing step-by-step instructions and ensuring a smooth experience.

- Language options: Offer multiple language options on EBT screens to accommodate beneficiaries with diverse linguistic backgrounds. This ensures that all users can understand and navigate the ATM interface effectively.

- Transaction limits and balance inquiries: Implement transaction limits and balance inquiry options specific to EBT transactions. This helps beneficiaries manage their funds effectively and plan their withdrawals accordingly.

- Security measures: Implement additional security measures, such as PIN entry, to protect beneficiaries' financial information during EBT transactions. Ensure that the ATM network complies with industry standards and regulations to maintain data security.

By implementing these EBT-specific features, you can create a user-friendly and secure ATM experience for your beneficiaries.

Promoting EBT ATM Usage and Awareness

To ensure the success of your EBT ATM strategy, it is crucial to promote awareness and educate beneficiaries about the availability and benefits of EBT ATM services. Consider the following promotional strategies:

- Outreach campaigns: Develop targeted outreach campaigns to inform beneficiaries about the location and availability of EBT-enabled ATMs. Utilize various communication channels, such as social media, email, and text messages, to reach a wider audience.

- Community engagement: Collaborate with community organizations, local businesses, and financial institutions to promote EBT ATM usage. Organize educational workshops or events to demonstrate the ease and convenience of EBT ATM transactions.

- Online resources: Create dedicated web pages or sections on your website to provide information about EBT ATM services. Include frequently asked questions, step-by-step guides, and contact details for further assistance.

- Partnerships: Establish partnerships with financial institutions and ATM networks to promote EBT ATM usage. Encourage these partners to promote EBT services through their channels, such as branch locations or online platforms.

By implementing a comprehensive promotional strategy, you can increase awareness and adoption of EBT ATM services among your target audience.

Monitoring and Evaluating EBT ATM Performance

Regular monitoring and evaluation of your EBT ATM strategy are essential to identify areas for improvement and ensure its effectiveness. Consider the following steps:

- Transaction data analysis: Collect and analyze transaction data from EBT ATM transactions. Look for patterns, trends, and any potential issues that may arise. This data can help you optimize your strategy and address any bottlenecks.

- Beneficiary feedback: Encourage beneficiaries to provide feedback on their EBT ATM experience. Collect feedback through surveys, focus groups, or online feedback channels. Use this feedback to enhance the user experience and address any concerns or suggestions.

- Performance metrics: Define key performance indicators (KPIs) to measure the success of your EBT ATM strategy. These may include transaction volume, transaction success rates, and beneficiary satisfaction levels. Regularly review these metrics to assess the overall performance and make data-driven decisions.

- Continuous improvement: Based on the insights gained from monitoring and evaluation, implement continuous improvement initiatives. This may involve refining ATM network coverage, enhancing EBT screens, or introducing new features to improve the overall EBT ATM experience.

By actively monitoring and evaluating your EBT ATM strategy, you can ensure its long-term success and provide a seamless experience for your beneficiaries.

Note: Collaborate with stakeholders and seek their input throughout the process to ensure a holistic and effective EBT ATM strategy.

Designing an EBT ATM strategy requires careful planning, research, and collaboration. By understanding your target audience, selecting the right ATM network, implementing EBT-specific features, and promoting awareness, you can create a successful and user-friendly EBT ATM experience. Regular monitoring and evaluation will further enhance the strategy's effectiveness, ensuring that beneficiaries can access their benefits conveniently and securely.

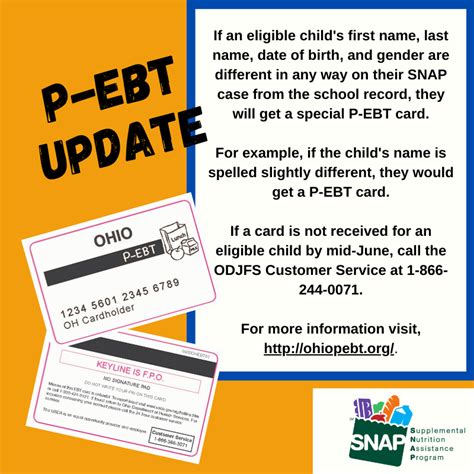

What is EBT, and how does it work?

+

EBT stands for Electronic Benefits Transfer. It is an electronic system used by government agencies to distribute benefits, such as food assistance and cash benefits, to eligible individuals and families. EBT cards are similar to debit cards and can be used at ATMs and point-of-sale terminals to access and utilize these benefits.

How can I locate EBT-enabled ATMs in my area?

+

You can typically find EBT-enabled ATMs by checking the website of your state’s EBT program or by contacting the customer service number provided on your EBT card. Many ATM networks also offer locator tools on their websites, allowing you to search for EBT-enabled ATMs near you.

Are there any fees associated with EBT ATM transactions?

+

Fees for EBT ATM transactions may vary depending on the ATM network and your state’s EBT program. Some transactions may be fee-free, while others may incur a small fee. It is recommended to check with your state’s EBT program or the ATM network for specific fee information.

Can I use my EBT card at any ATM?

+

Not all ATMs accept EBT cards. It is important to look for EBT-enabled ATMs, which are specifically designated for EBT transactions. These ATMs will have signage or symbols indicating their compatibility with EBT cards. It is always a good idea to check before attempting a transaction to avoid any potential issues.

What should I do if I encounter issues with my EBT ATM transaction?

+

If you experience any problems with your EBT ATM transaction, it is recommended to contact your state’s EBT customer service hotline. They can provide assistance and guidance specific to your EBT program. Additionally, you can try another EBT-enabled ATM or contact your caseworker for further support.