Design Federal Tax Brackets: The Ultimate Guide

Designing federal tax brackets is a complex process that involves careful consideration of various factors to ensure fairness and efficiency in the tax system. In this guide, we will explore the key aspects of federal tax brackets, from understanding their purpose to implementing effective strategies for tax planning. By the end of this article, you'll have a comprehensive understanding of how tax brackets work and how to navigate them successfully.

Understanding Federal Tax Brackets

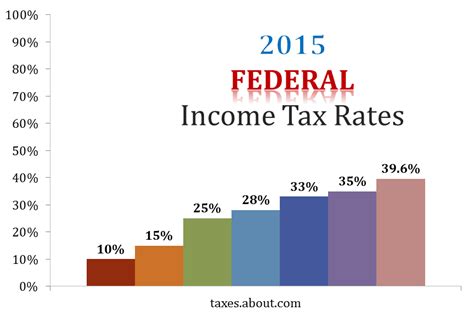

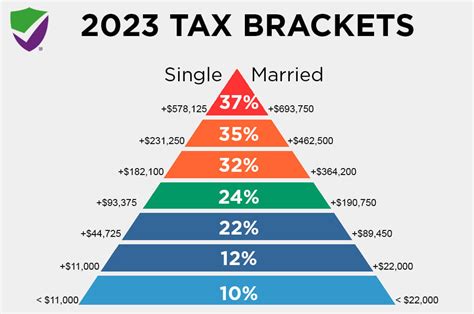

Federal tax brackets are a fundamental component of the US tax system. They determine the tax rate that applies to different levels of income. These brackets are designed to create a progressive tax structure, where higher income earners pay a higher percentage of their income in taxes. This progressive nature aims to promote equity and support government programs and services.

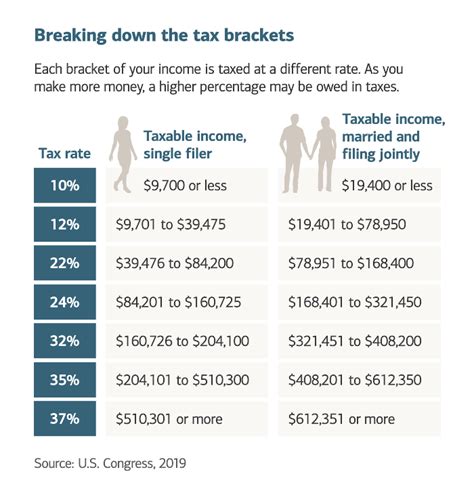

The tax brackets are divided into different income ranges, and each range is associated with a specific tax rate. As an individual's income increases, they move into higher tax brackets, resulting in a higher tax liability. It's important to note that tax brackets are not uniform across the country; they can vary based on factors such as filing status (single, married filing jointly, head of household) and the state of residence.

How Tax Brackets Work

When it comes to understanding tax brackets, it's crucial to grasp the concept of marginal tax rates. The marginal tax rate represents the tax rate applied to the next dollar of income earned. For example, if you are in the 22% tax bracket, it means that every additional dollar you earn above a certain threshold will be taxed at a rate of 22%. However, it's essential to understand that only the income within that particular bracket is taxed at that rate; income below the threshold is taxed at lower rates.

To illustrate this, let's consider an example. Imagine you are a single filer with a taxable income of $60,000. The tax brackets for the 2022 tax year are as follows:

| Tax Bracket | Tax Rate | Income Range |

|---|---|---|

| 10% | $0 - $10,275 | |

| 12% | $10,276 - $41,775 | |

| 22% | $41,776 - $89,075 | |

| 24% | $89,076 - $170,050 | |

| 32% | $170,051 - $215,950 | |

| 35% | $215,951 - $539,900 | |

| 37% | $539,901 or more |

In this scenario, your income falls within the 22% tax bracket. However, this doesn't mean that your entire income is taxed at 22%. Instead, only the income above $41,775 is taxed at this rate. The income below this threshold is taxed at lower rates. This progressive tax structure ensures that individuals with higher incomes contribute a larger share of their income to taxes.

Calculating Your Tax Liability

Calculating your tax liability involves a series of steps. First, you need to determine your taxable income, which is your total income minus any deductions and exemptions. Once you have your taxable income, you can refer to the tax brackets to find the applicable tax rate for each portion of your income. By multiplying the income within each bracket by its respective tax rate, you can calculate the tax due for that bracket. Finally, sum up the taxes from each bracket to arrive at your total tax liability.

Let's continue with the previous example. Your taxable income is $60,000. Here's a breakdown of how your tax liability is calculated:

- Income from $0 to $10,275 (10% tax bracket): $1,028

- Income from $10,276 to $41,775 (12% tax bracket): $3,775.20

- Income from $41,776 to $60,000 (22% tax bracket): $3,964.80

Your total tax liability for this scenario would be $8,768.

Tax Planning Strategies

Understanding tax brackets allows you to make informed decisions about tax planning. Here are some strategies to consider:

1. Maximize Deductions and Credits

Take advantage of deductions and tax credits to reduce your taxable income. This can help you stay within lower tax brackets and lower your overall tax liability. Common deductions include mortgage interest, state and local taxes, and charitable contributions. Additionally, explore tax credits such as the Child Tax Credit or the Earned Income Tax Credit, which can provide significant savings.

2. Utilize Retirement Accounts

Contributing to retirement accounts, such as 401(k)s or IRAs, can provide tax benefits. These accounts allow you to reduce your taxable income in the present while saving for the future. Contributions to traditional retirement accounts are typically tax-deductible, and the earnings grow tax-free until withdrawal. This strategy can help you stay in lower tax brackets and defer taxes until retirement.

3. Invest in Tax-Efficient Assets

Consider investing in assets that offer tax advantages. For example, municipal bonds are tax-exempt at the federal level, which can reduce your taxable income. Additionally, investing in real estate can provide tax benefits through depreciation and certain tax deductions. Consult with a financial advisor to explore tax-efficient investment options.

4. Tax Loss Harvesting

If you have investments that have declined in value, consider selling them to realize capital losses. These losses can be used to offset capital gains and reduce your taxable income. However, be cautious not to violate the wash sale rule, which prohibits repurchasing substantially identical securities within 30 days before or after the sale.

5. Estate Planning

Estate planning can involve strategies to minimize the tax burden on your heirs. By utilizing trusts, gifting strategies, and other estate planning tools, you can ensure that your assets are transferred efficiently and with minimal tax impact.

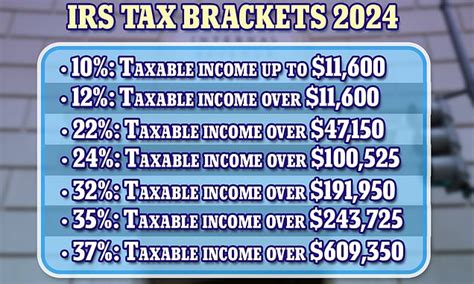

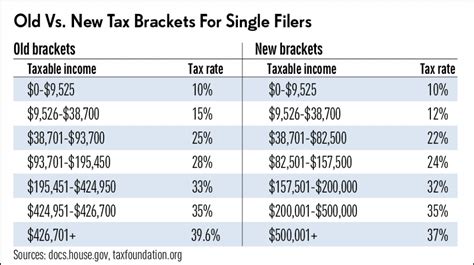

Staying Informed About Tax Bracket Changes

Tax brackets are subject to change annually, and it's essential to stay informed about these changes. The IRS typically releases the updated tax brackets for the upcoming tax year, and you can find this information on their official website or through reputable tax resources. Being aware of bracket adjustments allows you to plan your finances accordingly and make informed decisions about your tax strategy.

Conclusion

Designing federal tax brackets is a complex process that aims to create a fair and progressive tax system. By understanding how tax brackets work and implementing effective tax planning strategies, you can navigate the tax landscape successfully. Remember to stay informed about tax bracket changes and consult with tax professionals or financial advisors to ensure you're making the most of your tax planning opportunities.

What is the purpose of federal tax brackets?

+

Federal tax brackets are designed to create a progressive tax system, where higher income earners pay a higher percentage of their income in taxes. This promotes equity and supports government programs and services.

How often do tax brackets change?

+

Tax brackets are subject to annual adjustments. The IRS releases the updated tax brackets for the upcoming tax year, typically based on inflation and economic factors.

Can I reduce my tax liability by staying within a lower tax bracket?

+

Yes, by maximizing deductions, credits, and tax-efficient investments, you can reduce your taxable income and potentially stay within a lower tax bracket, resulting in lower tax liability.

Are tax brackets the same for all states in the US?

+

No, tax brackets can vary based on the state of residence. Some states have their own tax brackets and rates, while others follow the federal tax brackets. It’s important to consider both federal and state tax brackets when planning your finances.