Design 7 Ultimate Strategies For Texas State University Tuition Today

Paying for college tuition can be a daunting task, especially when it comes to a prestigious university like Texas State. The cost of education is on the rise, and finding ways to make it more affordable is a priority for many students and their families. In this blog post, we will explore seven ultimate strategies to tackle Texas State University's tuition and make your college dreams a reality.

1. Explore Financial Aid Options

Financial aid is a crucial aspect of funding your education. Texas State University offers a range of financial assistance programs to support students in need. Start by completing the Free Application for Federal Student Aid (FAFSA) to determine your eligibility for federal grants, work-study programs, and loans.

Additionally, Texas State provides various scholarships and grants specifically for its students. Research and apply for these opportunities early on. Check the university’s website for detailed information on financial aid, scholarships, and the application process.

2. Apply for Scholarships

Scholarships are an excellent way to reduce the financial burden of tuition. Texas State University offers numerous scholarships based on academic merit, financial need, and specific criteria such as major, extracurricular activities, or community involvement.

Explore the different scholarship options available and identify those that align with your strengths and interests. Pay close attention to the application requirements and deadlines. Many scholarships have specific essay prompts or additional materials, so ensure you submit a competitive application.

Consider seeking scholarships outside of the university as well. Local organizations, community groups, and national foundations often provide scholarships for deserving students. Research and apply for these opportunities to increase your chances of receiving financial support.

Tips for Scholarship Applications:

- Start early and plan your application strategy.

- Create a comprehensive list of scholarships you are eligible for.

- Read the application guidelines carefully and follow them precisely.

- Write compelling essays that showcase your unique qualities and experiences.

- Seek feedback on your application materials from teachers, counselors, or mentors.

3. Consider Work-Study Programs

Work-study programs offer a unique opportunity to earn money while gaining valuable work experience. Texas State University participates in the Federal Work-Study program, providing part-time jobs for students with financial need.

These jobs are typically on-campus, allowing you to balance your studies and work responsibilities effectively. The earnings from work-study positions can contribute significantly to covering your tuition costs.

To participate in the work-study program, you must complete the FAFSA and indicate your interest in work-study. The financial aid office will assess your eligibility and connect you with suitable job opportunities.

4. Explore Part-Time Job Opportunities

If you’re unable to secure a work-study position or require additional income, consider part-time jobs off-campus. Many students work part-time to support their tuition expenses.

Look for jobs that align with your schedule and allow you to manage your studies effectively. Retail, hospitality, and customer service industries often offer flexible part-time positions. You can also explore freelance work or tutoring opportunities to earn extra income.

Remember to prioritize your academic performance while working. Effective time management and organization are key to balancing work and studies successfully.

5. Utilize Student Loan Options

Student loans can be a viable option to bridge the gap between your financial aid package and the cost of tuition. Texas State University provides information and resources to help students understand their loan options.

Explore federal student loans, which typically offer more favorable terms and interest rates compared to private loans. Consider the different types of federal loans available, such as Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans.

Research and compare loan providers to find the best interest rates and repayment plans. Understand the terms and conditions of the loans, including interest rates, repayment periods, and any potential fees.

Tips for Managing Student Loans:

- Borrow only what you need and consider future repayment responsibilities.

- Create a budget and track your expenses to avoid overspending.

- Explore loan forgiveness programs or income-driven repayment plans.

- Consider making interest payments while still in school to reduce the overall cost.

- Stay informed about your loan status and repayment options.

6. Save and Plan Ahead

Planning and saving for college tuition is a long-term commitment. Start early and take advantage of various savings options.

Encourage your parents or guardians to contribute to a 529 college savings plan, which offers tax benefits and can be used for qualified education expenses.

If you’re an independent student, consider opening a high-yield savings account specifically for your education funds. Save a portion of your income from part-time jobs or freelance work to build a substantial savings pool.

Additionally, explore part-time work opportunities during your high school years to boost your savings. Every dollar saved can make a significant difference in reducing the overall cost of tuition.

7. Attend Community College First

Attending a community college for the first two years of your undergraduate education can be a cost-effective strategy. Community colleges often offer lower tuition rates and smaller class sizes, providing a solid foundation for your academic journey.

After completing your associate’s degree at a community college, you can transfer to Texas State University to finish your bachelor’s degree. Ensure that you choose a community college with an established transfer agreement or articulation with Texas State to maximize the credits you can transfer.

This approach not only saves you money but also allows you to adjust to college life gradually before transitioning to a larger university.

Conclusion

Paying for Texas State University’s tuition is a challenging but achievable goal. By exploring financial aid options, applying for scholarships, and considering work-study programs, you can significantly reduce the financial burden. Part-time jobs, student loans, and long-term savings plans are additional strategies to consider.

Remember, planning and taking advantage of various opportunities can make your college dreams a reality. With dedication and a well-thought-out financial strategy, you can navigate the path to an affordable education at Texas State University.

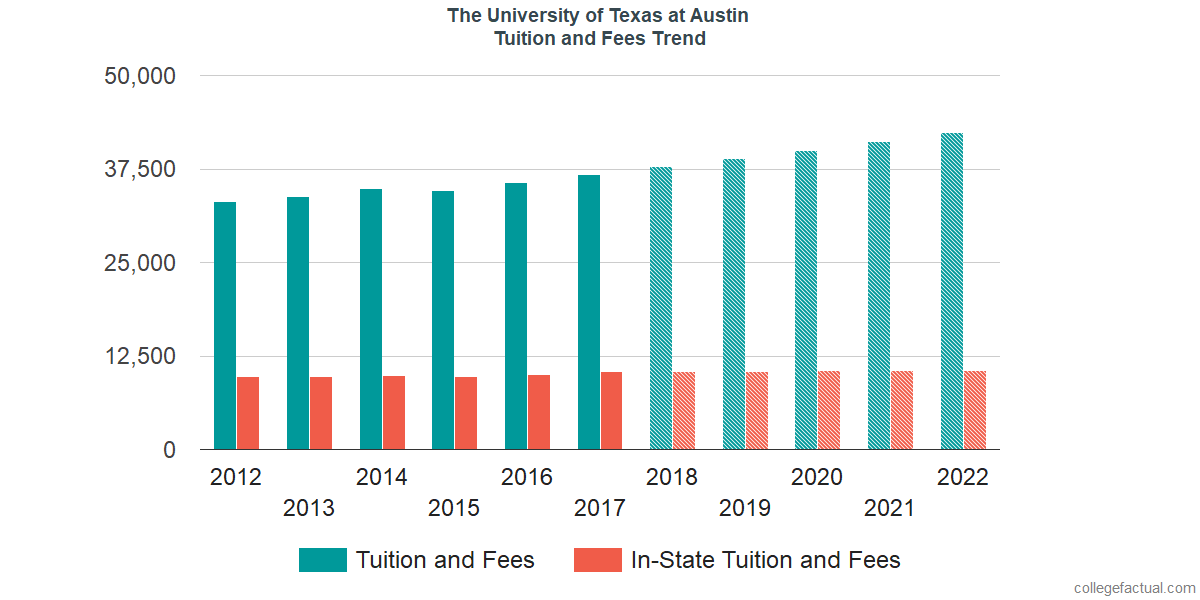

What is the average cost of tuition at Texas State University?

+

The average cost of tuition at Texas State University varies depending on factors such as residency status and the program of study. As of the 2022-2023 academic year, in-state undergraduate tuition is approximately 10,000 per year, while out-of-state undergraduate tuition is around 25,000 per year. Graduate tuition rates can be higher, ranging from 12,000 to 20,000 per year for in-state and out-of-state students, respectively.

Are there any tuition waivers or discounts available at Texas State University?

+

Yes, Texas State University offers various tuition waivers and discounts to eligible students. These may include waivers for veterans, active-duty military personnel, and their dependents, as well as discounts for senior citizens and Texas residents who meet certain criteria. It’s important to check with the university’s financial aid office to explore these options and understand the eligibility requirements.

Can I receive financial aid if I’m an international student at Texas State University?

+

Yes, international students at Texas State University are eligible for financial aid, including scholarships and grants. However, the availability and amount of financial aid may vary for international students compared to domestic students. It’s recommended to research and apply for scholarships specifically designed for international students, as well as explore other funding options such as private loans or work-study programs.